The UK Import and Export Process is changing. Are you Ready?

The UK Import and Export Process is Changing.

The UK Government recently published Import and Export guidelines to help businesses prepare for January 2021.

From 2021 you will need to make a customs declaration, when exporting goods from the UK to the EU.

What is included in a customs declaration?

1. The HS Tariff Code for product identification

2. Details of your product including the value

What do you need to have in place?

An EORI number, which will start with the letters GB.

Separate EORI numbers will be required for any import or export declarations made within EU countries.

For more information regarding what you need to do to get ready for January 2021 you can visit the Government information pages here

What is a HS Tariff Code?

HS stands for Harmonized System, which was developed by the WCO (World Customs Organisation), as a multipurpose international product naming system. It describes the type of goods that are being shipped.

If you want to ship your products internationally, you will need to enter these codes.

These codes provide customs with information, so that correct tariffs, can be applied to the order.

You may already be familiar with these codes, if you currently ship goods to the rest of the world.

HS Code Structure

A HS code consists of the following information: –

- A six-digit identification code.

- The code is made up of 5000 commodity groups.

- These groups have 99 chapters.

- These chapters have 21 sections.

- It’s arranged in a legal and logical structure.

- Well-defined rules support it to realise uniform classification worldwide.

Today, HS codes are used extensively in electronic messages like the EDIFACT. Its nearly universal usage allows authorities, such as Port and Customs departments, to identify products.

HS codes form the basis for tariff codes all over the world. For instance, the UK takes their commodity codes from the first 6 digits from the corresponding HS code.

How do I find the HS Tariff /Commodity Code for my product?

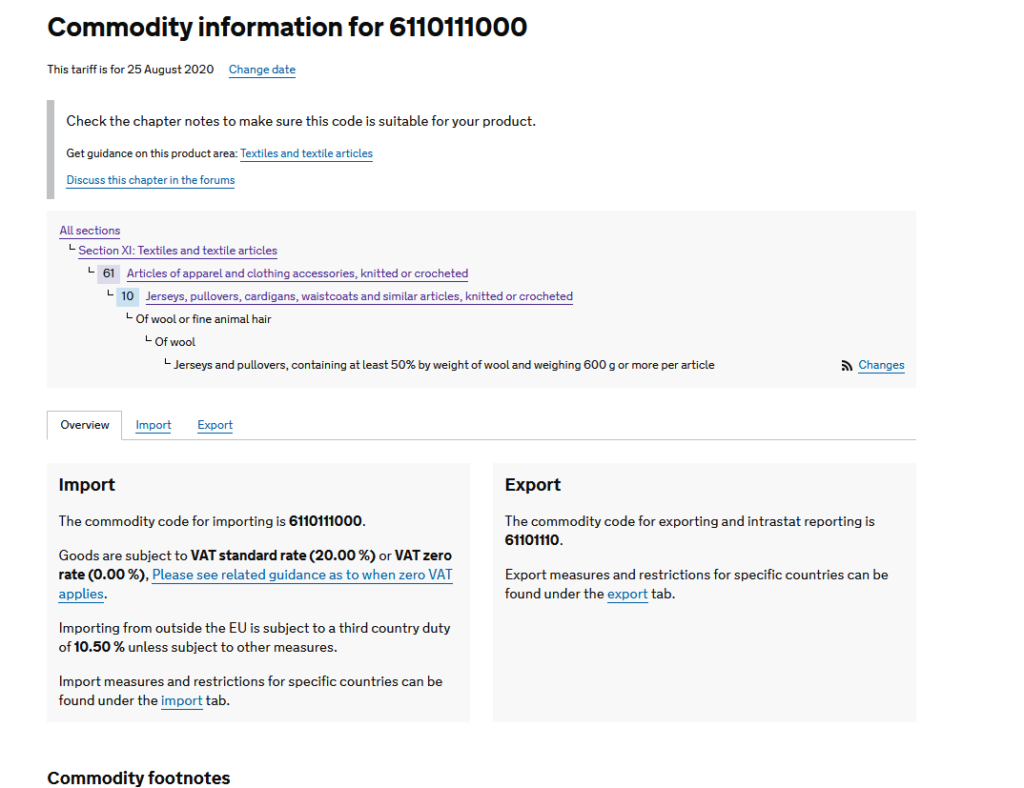

For example, you own a company that sells woollen jumpers.

- The government code calculator can be found here this asks you to input information regarding your product materials, in order to calculate the Commodity code, based upon the information you provide. The commodity code for importing will be a ten digit number and the commodity code for exporting will be an eight digit number.

It will look like the extract below. In this instance we chose a woollen jumper which contains at least 50% by weight of wool and weighing 600g or more per article. The calculator then provided the HS Code based upon this information. It is important that you read the chaper and footnotes to ensure that you have the correct HS code for your product.

So, it’s time to start getting prepared. For more information about getting ready for January 2021, why not visit

https://www.gov.uk/government/news/getting-ready-for-the-customs-declaration-service

Have a chat with us today about how we can fulfil your UK and International orders and ensure that you don’t face any barriers to growth.

More from the bunker

Third Party Logistics (3PL) – Who Can Help Me With My Fulfilment Needs? Third Party Logistics (3PL) Who can help me with my fulfilment & third party logistics (3PL) needs? Contact Us 3PLUK… Read more

Shropshire Based Fulfilment Company To Expand Its Operations And Open EU Hub In The Netherlands 3PLUK Has Grown. Our EU Hub In The Netherlands is live. The expansion of our fulfilment operations, will open up… Read more